Roth ira estimator

Check the Traditional IRA. Subtract from the amount in 1.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Find out what tax deductions you can and cant take when it comes to your Roth IRA.

. To take a qualified distribution and avoid any tax liabilities you must wait until after the five-taxable-year period beginning with the taxable year in which you first contributed to a Roth IRA. Limits on Roth IRA contributions based on modified AGI. Enter the Non-Deductible Contribution to a Traditional IRA Sign in to your TurboTax account.

2022 - Amount of Roth IRA Contributions You Can Make for 2022. Your Roth IRA contribution might be limited based on your filing status and income. Available in TurboTax Self-Employed and.

Select Start or Revisit next to Traditional and Roth IRA Contributions. Best places to roll over your 401k. Locate the Retirement and Investments section and select Show more.

198000 if filing a joint return or qualifying widower -0- if married filing a separate return and you lived with your spouse at any time during the year or. The same combined contribution limit applies to all of your Roth and traditional IRAs. Youll still have a 45000 taxable distribution from the conversion even though the Roth account is now worth only 35000.

2021 - Amount of Roth IRA Contributions You Can Make for. Rates could change after account opening. Rates are subject to change monthly and are fixed for the term of the certificate.

Open your return if its not already open. Best Roth IRA accounts. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal.

Going back to our example lets say the value of the Roth IRA drops from the initial 50000 to 35000. Start with your modified AGI. Fortunately you can avoid this unfavorable outcome by reversing the Roth account back to traditional IRA status.

Select Federal from the menu then Deductions. Your dwelling coverage is fairly easy to calculate because property insurers have cost-estimator tools available to help determine. When the value of your investments in a Roth IRA Roth Individual Retirement Account decreases you might wonder if there is a way to write off those losses on your federal income tax return.

In 2020 the Roth IRA contribution limit is 6000 or 100 of income a child earns whichever is less. However you can take.

Ira Calculator See What You Ll Have Saved Dqydj

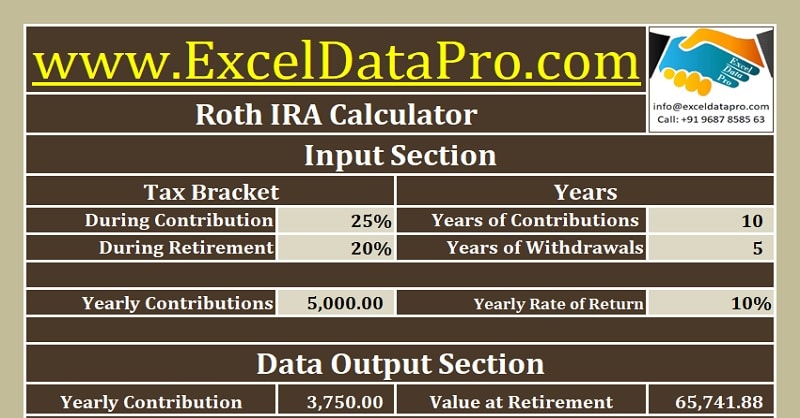

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

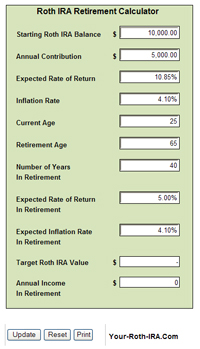

Roth Ira Calculators

Best Roth Ira Calculators

Roth Ira Calculators

Download Roth Ira Calculator Excel Template Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Roth Ira Contribution